Over many years, e-commerce websites and mobile applications have been increasing enormously; and, so are payment gateway service providers. Unlike the old days, now, to make an online payment for products and services on a site is not an overwhelming task for customers.

As per the research, 86 percent of clients buy online deals using their credit or debit cards, and more than 60 percent believe it to be their favored payment method while shopping online.

A payment gateway is nothing but a mediator that interfaces between your shopping cart and the credit card/debit card company. It mostly helps in preparing credit cards and guarantees the payment is made. It acts as an interfacing gateway, through which transactions should be possible consequently between a merchant and customer.

The recognized payment gateways are Braintree, PayU, Amazon Payments, Stripe, PayPal, Skrill, just to give some examples.

They do offer complete payment solutions like setting up a platform, making connections and enabling security. For many small-scale vendors, the simplicity of a payment gateway is a decent way to enable the online business.

Here is a snappy guide on the requirement of payment gateway and factors to be taken into consideration to choose a payment gateway for your business.

What is a payment gateway? Why do you need it?

A payment gateway is a digital service that proceeds the credit card/debit card payments for online and traditional stores. It encourages a transaction via the internet by imparting transaction data and applies to what could be compared to a real purpose of offer.

The utility of this mode of payment processing is that it enables organizations to acknowledge credit cards and some other payment methods. It associates the merchants with the bank’s account handling platform.

Without a payment gateway integration, the clients won’t have the option to pay for the services or items they are purchasing online. It is important to acknowledge electronic payments for any business

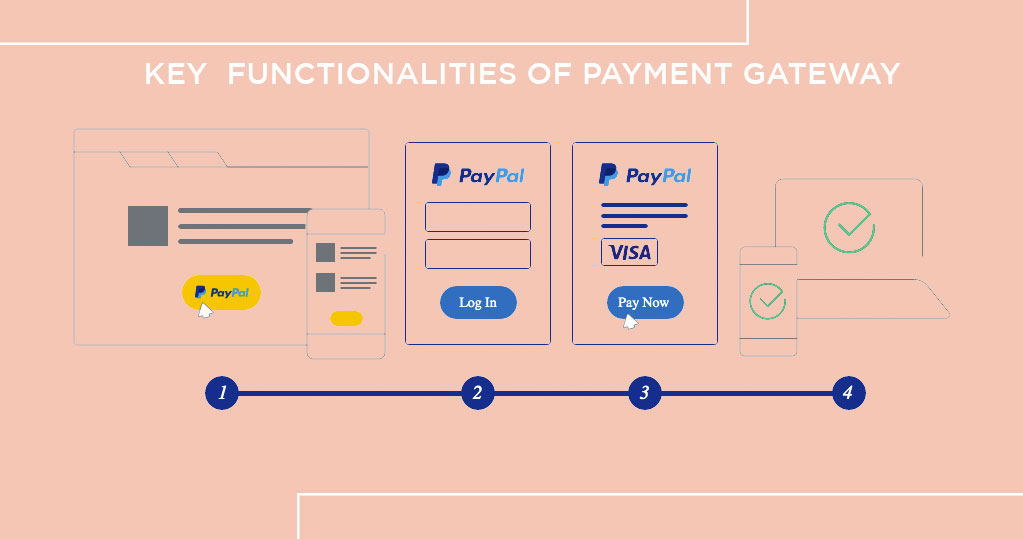

Key Functionalities of Payment Gateway

- Data encryption

The web browser encodes the information. The gateway, at that point, sends the transaction data to the payment processor used by the seller’s acquiring bank. - Filling the request

The processor authorizes payment request relating to the merchant and customer to the payment gateway. When the portal gets this response, it transmits it to the site/interface to process the payment. - Delivery address check

Now, the payment gateways cross-check delivery address mentioned in the database and provide at the payment gateway. In case you want your order to be delivered at different addresses or shipping and billing address are different, you need to confirm. If the auto-fill option is not available or the address is new, the customer needs to fill the details manually. - AVS checks

In the case of virtual card transactions, the payment gateway performs AVS checks. Address Verification Service (AVS) check is used to prevent cyber frauds. AVS failure occurs when the billing address of the user doesn’t match with the bank address of the user. - Computer fingerprinting technique

The computer fingerprinting technique is also used by payment gateways to enable transactions in case of physical purchase in the store. If the fingerprint of the card bearer matches at the time of making payment, then only the payment will be successful. - Velocity pattern analysis

Payment gateways do employ velocity pattern analysis as a fraud detection technique. Under the Velocity pattern analysis, the recurring transaction patterns are checked within a specific time frame to avoid the reoccurrence of the same or notify the owner of the card in that case. - Geo-location

Geolocation tracking is another feature of payment gateways that enable you to keep track of your transactions and report the faulty ones.

What is the need for a merchant account? Are there any alternatives for the same?

A merchant account is a sort of ledger that enables organizations to accept payments in numerous manners. Since its a digital account, it mostly involves transactions via debit or credit cards.

A merchant account is created between a retailer, a merchant bank and payment processor for the settlement of credit card and additionally debit card transactions. In the case of online shopping, a merchant account goes virtual. It maintains all the digital transactions between the retailer, commercial bank, and payment processor. You can call it an internet merchant account.

In case, you don’t want to open a merchant account; you can opt for the below options:

- PayPal enables the options for online payments for the merchants that don’t require a merchant account. It’s perfect for businesses hoping to begin with online transactions quickly, effectively, and economically.

- Credit card reader gadgets that are fitting into smartphones and iPads are accessible to the sellers.

How to choose the right payment gateway?

We know that selecting the right payment gateway can be tricky. However, the following factors can be helpful for you:

-

Security

You must check how secure is the payment gateway you are looking for. The security of the system enables your clients not to stress that their financial data will stay secure when acquiring from your store. Likewise, search for PCI-consistence, as this is basic when accepting credit cards online. The short rundown of payment gateway security layers:

– Every payment gateway has elevated level encryption (SSL encryption 128 Bit scrambled) to evade a wide range of breaks.

– Digital Signature comes under the second layer of security. If a programmer got your ID, your records could be marked safe with an advanced signature.

– After the digital signature comes to the role of Dynamic IPs. In any case, if your record is accessed from another IP address, the access will be denied.A couple of clients may not be aware of the diversion of the site to an outsider site to process their transactions securely. While choosing a payment gateway, ensure your platform gives the right security features, and search for a PCI-DSS accreditation, for example, hostile to extortion insurance.

-

Data Portability

If you are using a payment gateway for quite some time, but you don’t feel it is easier to use. In such a case, if you like to leave your payment gateway, what will happen to information about your existing customers. Will that be secure? Can you extract that information? When you look for the payment gateway that you like to integrate on your ecommerce store, you must check if it offers a data portability feature.

-

Hosted versus integrated payment gateways

– Hosted payment gateways divert your customers to the payment processor’s platform to let them put their payment data. Hosted gateways are anything but difficult to set up and are good for new stores. However, they can reduce conversion rates if customers aren’t acquainted with the processor.

– An integrated payment gateway interfaces with your eCommerce site utilizing the feature of API integration. Its greatest benefit is clients never have to leave your store to enter payment data and complete orders.

When selecting the payment gateway for your store, check your purpose, and select which one of these suits your requirements better. -

User Experience

User doesn’t like the complexity of the web page. Also, nowadays, most customers are using mobile apps over desktops. So, choose the ecommerce payment gateway that works well across the mobile as well as the web interface.

-

Globally acceptable

While the nations utilize the upside of the worldwide market, ensure that your chosen payment gateway works globally. Your clients may originate from any side of the globe. So you ought to permit universal payments.

-

Business model

Under your business model and take a look at your requirements and expectations from the payment gateway in the near future. As per your business model, it will be easier for you to select the right payment gateway for your online store.

-

Future technologies

If you intend to be in the business for over ten years at that point, coordinate blockchain records like Bitcoin and Ethereum to your online store, site, or application.

-

Fees

As pricing processing for payment handling and payment gateways are usually founded on the sort of transactions a business conducts (online or mix of virtual and, face to face), and even business deals, income consistency, transaction frequency, and the business sectors served; it’s vital to contrast how the business model concurs and the payment supplier, or gateway’s fee structure. A couple of services may require setup fees and agreements, or they may build transaction fees if the request and transaction volume that was normal when services were developed, isn’t met. So be certain it fits your budget, and that it isn’t extreme contrasted and other payment gateway offerings.

-

Customer support

There are a few payment gateways that don’t offer any technical assistance. In such circumstances, clients need to adhere to manual instructions to fix an issue. To avoid such cases, check whether the business offers live support, at any cost inside standard working hours, with the goal that you can rapidly resolve any technical issues.

Check whether the supplier offers live technical help, at any rate inside standard working hours, so you can rapidly resolve any specialized issues.

Guarantee successful transactions

As per the survey, more than 25 percent of clients will relinquish a purchase on the off chance that they are compelled to enroll for a record to finish it. On the off chance that your checkout method utilizes a third-party shopping cart with an enlistment procedure incorporated with the cart, guarantee that you can make it an optional factor that takes into account “guest” checkout. In like manner, your payment gateway should empower you to expel undesirable structure fields for simple checkout. Big eCommerce businesses expect that online retailers can help transformations by 50 percent, by evacuating redundancies, for example, needing the client to enter both billing and shipping data, regardless of whether the postal locations are the equivalent.

Multiple features to browse

Payment gateway specialist co-ops offer a few features, contingent upon your business needs. For instance, if you have to provide your products and services around the globe, your payment gateway ought to have the option to acknowledge a few credit cards, platinum cards, and monetary standards, given various nations.

Simple integration process

With regards to playing out a financial procedure, it is essential to incorporate payment preparing into your ecommerce website. As a rule, the perfect solution is to pick a supplier that will send your client to the third-party website to enter credit card data. The specialist co-op sends it back to your online shop when the transaction is finished.

Conclusion

Choosing and executing the correct payment gateway isn’t that tough or cost-prohibitive if you know your business needs. By doing it accurately, you can have an immediate and positive effect on your client’s understanding, just as your income and productivity. All you must do is, proper research and consider the above-discussed variables, before selecting the right payment gateway.

We believe this post will assist you in picking the correct payment gateway. For greater clarity on payment gateways or if you require any digital assistance, feel free to email us at support@builderfly.com.