All businesses start with a specific goal in mind. For most, it’s profit.

Even at not-for-profit organizations – or when the main driver of a business is a personal goal, like being able to work more flexibly – income is almost always needed for sustainability.

Entrepreneurship can deliver on the various freedoms it promises, but success requires an active understanding of a business’s finances – which starts with knowing hat to measure.

As management consultant Peter Drucker says, “What gets measured gets managed.” – so here are four key metrics of eCommerce profitability.

Your discounting strategy

CAC and Gross profit margin are the building blocks for making a decent discounting strategy. Too often, I see eCommerce businesses with an aggressive and significant discounting strategy — but with zero visibility into how that relates to their gross profit and CAC.

Consider this scenario:

- You have an Average Order Value (AOV) of $100.

- A gross profit margin of 30% leaves you $30 gross profit on an average order.

- Your CAC is about $15, which means you are earning $15 per $100 order (or about 15%).

If a discount is more than 15%, this business will probably be making a loss on that sale.

Making a loss on some sales might not be a problem; when you do it as a loss-leader strategy, it can be very beneficial. However, you can only know that you are in a safe space if you understand what your discount tactic looks like to your CAC and gross profit margin.

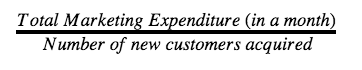

Customer Acquisition Cost (CAC)

Your Customer Acquisition Cost is the average dollar amount you spend to acquire a new customer (i.e., attracting them and persuading them to purchase from you).

This is the easiest way to calculate your CAC:

Like calculating your gross profit margin, calculating your CAC implies scrutinize your costs and finding everything related to marketing. Here are a few of the more common costs most eCommerce businesses incur:

- Paid advertising on Facebook Ads or Google Adwords, along with any offline ad spend.

- Software, like your email marketing solution and your popup/lead capturing tools.

- Team members that are specifically involved in marketing — you can allocate either their full salary or a portion based on how much of their time they spend on marketing when calculating your CAC.

Oftentimes, businesses find that their CAC is out of control and exceeding their gross profit margins. It’s possible to use a loss-leader strategy in the short-term and for some products, but selling your products at a loss over an extended period may put your business at risk.

Free cash flow

Many businesses die because they run out of cash — even businesses that show an accounting profit.

All of the metrics above affect your financial profitability: If you just monitor these and improve them gradually, you ought to see your profitability grow effectively. However, for a complete analysis, you should still weigh growth in profitability against the cash available in your business.

A definition of free cash flow:

“Free cash flow is the capital a company generates through its operations, less the cost of expenses on assets.”

When you order new stock from your supplier, they need payment before they ship that stock. To make that happen, you need cash reserves. If you are unable to pay for that stock, you may lose out on upcoming sales because you have no available inventory.

This is why it is important to understand how much cash flows in and out of your business every month; you can then plan accordingly and keep an appropriate level of capital in reserve for undesired expenses. Doing so will help you maintain both safe margins for emergency scenarios, but also ensure that you always have funds available to reinvest in your growth.

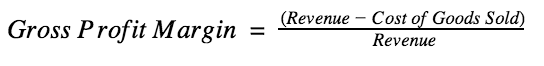

Gross profit margin

Gross profit margin is a financial metric utilized to analyze an organization’s business model and financial health by reporting the proportion of cash saved from revenues after accounting for the cost of goods sold.

Gross profit margin is critical because it immediately gives you an overview of how your current revenue is serving the rest of your business, and whether it is doing so at a profit or a loss. This has a far-reaching impact on your strategic and tactical options for how to run your business.

The following are a couple of tips to improve your understanding of your gross profit margin:

- Invest in your inventory tracking. The cost of your inventory is the primary driver of your COGS, which is what you use to calculate your gross profit margin. If you don’t have reliable data about your inventory expenses and how that relates to your sales, you are beginning with an unstable basis.

- Be as granular as possible. Discover all the variable costs that are associated with making a sale and add them to your calculation. If possible, include all of your freight, import, and manufacturing costs, as well as expenses like packaging and shipping.

Your first step to financial freedom

It’s hard to build a successful business without really understanding these metrics. The starting should always be putting better tracking and monitoring in place. If you don’t have any insight into these metrics and you just started tracking them, the absolute numbers matter less. What matters more is that you have started the process, which will help you make improvements over time.

These four key metrics will provide you more options into how you leverage and tweak things in your business to ultimately achieve the goals you have set for yourself.