2019 stands to be one of the most imaginative, transformative and just plain intriguing years in retail.

With naysayers decrying the death of retail, fanatical continuing to double down on Facebook Ads (and selling courses to others on how to do the same), and the lines of precisely is retail, content and media blurring – minimal left untouched in the year before the new decade

We’ve broken some trends out to predictions for the entire industry all up, those specific for start-ups and those for large, legacy brands looking to stay relevant in 2020.

There are a couple of trends, specifically, that stand out across the board. These are our very own expectations for 2020.

Content & Commerce Take Precedence

Due to the high cost of paid media and paid media teams as well as consumers’ devouring of more top-of-funnel content, content and commerce will continue to be a money-maker for brands who invest appropriately. SEO is a major part of this effort, as is content network and distribution.

AI will make it all possible

To do all of this, brands need to maintain headcount and margins –– which means tasks that are manual right now by current employees will need to be offloaded to AI where efficiency and personalization can be managed and then executed by the human to deliver best-in-class experiences across all channels.

Paid Media Will Need Experts

The high cost of paid media (Google, Facebook, Amazon, etc.) and the difficulty in securing return on ad spend will make paid media teams ever-more important for ecommerce brands – and ever-more allusive and expensive to boot. Gone are the days where you could expect to hit $1,000,000 in revenue based on your own paid media education.

Headless Commerce Becomes Mainstream

The best commerce experiences and the content will remove hindrances to checkout. They will also create the best, most memorable customer experiences possible on the web (and off, but more on that in a bit). To accomplish both of those tasks, folks will lean more heavily on headless commerce using WordPress, Drupal or other CMS systems as their presentation layer of choice.

The retail workforce will change

To account for all of the offline experience needs, expect an increase in hiring from older generations who once built the meccas of retail experiences in their heyday. Millennials, by and large, don’t have the offline experience needed to execute these experiences at scale. Instead, millennials will continue to dominate online ecommerce and digital marketing channels, leveraging what is for the first time ever 4 generations of humans in the workforce simultaneously to satisfy what are now seeming to be generationally gained skills.

Experiences for In-Store Shopping Interactions

As online experiences become more and more seamless, brands will look to build moats around themselves with high-quality and high-interactivity offline experiences. These could be in the form of hotels (like Shinola’s hotel), events (like Sweetgreen’s events) or through malls (like Neighborhood Goods).

67 Data Points on The State of Ecommerce Around the World

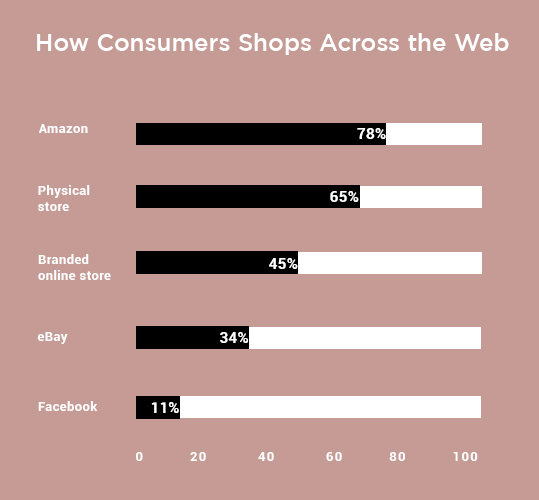

How Consumers Shop Across the Web

- When asked about their shopping behaviors prior to purchasing in a physical retail store, 39% of digital consumers visited a brand’s website, 36% read customer reviews, 33% attempted to price coordinate the item online, with 32% searching the brand on Amazon.

- In the last six months, 78% of global respondents to one survey made a purchase on Amazon, 65% in a physical store, 45% on a branded online store, 34% on eBay and another 11% Facebook.

How Consumers Shop On (or Because of) Amazon

- 22% of customers visited a brand site before buying it from Amazon

- In the last six months, 83% of US consumers purchased on Amazon. Look specifically at the digital-first Millennial generation in the US, and that number jumps to 90%. There’s no denying: Amazon is an integral part of all consumers’ shopping journeys.

- 30% of consumers saw a brand on Amazon before ultimately purchasing it on a brand’s website.

Online Security Concerns are Rising

- Site security concerns are top of mind most for Gen Z (9.91%).

- Three-quarters of consumers believe retailers are collecting email addresses (82%), physical addresses (75%) and phone numbers (74%).

- Another 56% of consumers believe online browsing history falls into the scope of a retailer’s data collection.

- 25% of respondents believe retailers collect information on salary, relationship status, and profession.

What Makes Consumers Purchase Goods

- The ability to touch and try on items is 3x more influential than other options in a consumer’s decision to purchase in a physical store.

- For 36% of respondents, financing enabled them to buy a more expensive option than they were previously considering

How the Generations Shop Online

- Only 56% of Gen Z consumers made a purchase in a physical store in the last six months compared to 65% of all respondents.

- 30% of Gen Z buyers saw an ad about the product on social media, and 22% visited at least one of the brand’s social channels prior to making an in-store purchase.

- 6% of online shoppers prefer mobile wallets over other forms of payment

- Only 4% of Gen Z reports expecting to return more than 75% of the items they buy online, but that 4% is 3X higher than their other generational counterparts.

- On average, all generations expect to return up to 25% of the goods they buy online.

Returns & Exchanges Data

- When it comes to returning items purchased online, 50% of consumers mail the item back.

How People Shop Online in Australia

- Australian respondents spend approximately 26% of their discretionary income on online purchases.

- Nearly half (48%) of Australian respondents visited a brand’s website before purchasing in-store, and another 28% read customer reviews about the brand or product.

- only 24% of Australian respondents made a purchase there in the last six months.

- Fifty-seven percent of Australian respondents do not think the presence of more global retailers will impact their decision to buy from local merchants.

- Only 58% of survey respondents in Australia indicated they would opt-out of sharing data with retailers if given the option.

- Australian respondents said, on average, they would cap online spending at $473, compared to a max of $922 in the UK and $798 in the US.

How People Shop Online in the UK

- Convenience barely beats out price as a primary influencer for UK buyers, at 26% and 24% respectively.

- UK respondents believed paying for shipping costs to be the worst part of online shopping (24%), followed by waiting to receive the product (17%) and, finally, an inability to touch or try on the product (16%).

- 23% of UK respondents have requested retailers delete their data

- 80% of UK respondents are familiar with GDPR

- 69% of UK respondents believe retailers respect their right to privacy

Want more insights on trends online like this? Get in touch with Builderfly experts and see how your e-store can compete in this ecommerce world.